Saturday, January 31, 2026

Friday, January 30, 2026

Thursday, January 29, 2026

Wednesday, January 28, 2026

War Drums In Gulf: US Armada Arrives As Saudi Arabia, UAE Deny Airspace Access

It appears this prophecy is shaping up.

It appears this prophecy is shaping up.

Things between Tehran and Washington are moving fast according to an eerily familiar pattern hearkening back to the lead-up to the 12-day June war, when there was some wrangling over negotiations - and talk of good faith efforts at dialogue - just before the US greenlighted a surprise Israeli attack which also saw US entry into the conflict by the close of it (whereupon nuclear facilities were hit by American bombers).

"Our stance is clear," Iran’s Foreign Minister Abbas Araqchi said Wednesday as the US has expressed the desire to strike a deal. "Negotiations don’t go along with threats, and talks can only take place when there are no longer menaces and excessive demands."

- IRAN SAYS WILL RESPOND TO US 'LIKE NEVER BEFORE' IF PUSHED

- IRAN SAYS READY FOR TALKS WITH US BASED ON MUTUAL RESPECT

- OIL PARES GAINS AS IRAN SAYS ITS READY FOR TALKS WITH US

Araqchi confirmed his country has had no recent communication with US special envoy Steve Witkoff and has not sought talks with Washington. President Donald Trump said Tuesday that another US "armada" was moving "beautifully" toward Iran, but he hoped Tehran would ultimately strike a deal and avoid conflict.

The Iranian FM noted, however, that unnamed intermediaries were "holding consultations" and remained in touch with Iranian officials.

Separately, Iranian President Masoud Pezeshkian told Saudi Crown Prince Mohammed bin Salman on Tuesday that Tehran supports any process "within the framework of international law" that helps avert war. The Saudis have joined the UAE in declaring that the US cannot use its airspace for aggression against Iran.

This shouldn't pose too big a challenge for the Pentagon, however, which has a build-up of assets at its Qatar base and with a carrier group near Iran in regional waters.

But The Wall Street Journal disagrees, saying this could be a significant setback if the White House wishes to pursue war plans:

The declarations from the two Gulf states represent a foreign policy setback for the Trump administration as it seeks to ratchet up pressure on Tehran, which has defied Washington’s demand that it halt uranium enrichment and end the suppression of protesters.

Crown Prince Mohammed bin Salman, the kingdom’s de facto leader, outlined his country’s position while talking by phone with Iranian President Masoud Pezeshkian.

A Saudi readout of the Tuesday call said the crown prince had stressed that the kingdom “will not allow its airspace or territory to be used for any military actions against Iran.”

Previously, during Monday remarks, President Trump said "They want to make a deal. I know so. They called on numerous occasions. They want to talk." He added ominously, "We have a big armada next to Iran. Bigger than Venezuela."

US forces stationed across the Middle East are also meanwhile taking part in large-scale war games aimed at showcasing combat readiness, as Washington ramps up its military footprint, and as Trump is presented with an array of 'options'. All of this supposedly steps from Washington 'concern' for large-scale protests from earlier this month, where thousands died - but which also included the deaths of police and security services.

In a statement which kicked off the week, US Central Command said: "Ninth Air Force will be conducting a multi-day readiness exercise to demonstrate the ability to deploy, disperse, and sustain combat airpower across the Central Command (CENTCOM) area of responsibility."

President Trump issued the following "time is running" out message Wednesday morning:

The command added that "this exercise is designed to enhance asset and personnel dispersal capability, strengthen regional partnerships and prepare for flexible response execution throughout CENTCOM."

The sweeping drills are unfolding against the backdrop of sharply rising tensions with Tehran in which an oil blockade and potential strikes on senior officials in the Islamic Republic are being considered. But in terms of blockades, two can play at that game, as the Strait of Hormuz remains among the most vital waterways for the global market, and the IRGC has threatened that its forces can shut it to international transit.

Tuesday, January 27, 2026

Monday, January 26, 2026

Sunday, January 25, 2026

They are well funded, well organized, trained and have excellent comms. Patriots should take notes.

From PM:

Independent journalist Cam Higby reports that he has infiltrated Signal group chats in Minneapolis being used by anti-ICE activists to track federal immigration agents and obstruct their operations across the state.

Higby published a detailed thread on X outlining the structure of the

groups, which he said operate daily and are organized to monitor,

identify, and interfere with ICE activity.

Higby said each area of the city operates its own group chat, with districts divided into “patrol zones” that guide activists on where to operate. He posted a screenshot of a map showing how the zones are organized.

“Here is a screenshot of the active dispatch call (it’s always active) as well as a shift change. You can see folks are changing their emojis, clocking in and out. I’ll also attach below a video of dispatch actually tracking the vehicle I was in claiming that we were ‘confirmed ICE.’ They constantly misidentify vehicles. Pay attention to emojis tagged on plate checks,” he wrote.

He also released a recording that he said shows protesters following a vehicle he was in after being labeled as ICE, with group members instructing “commuters,” a term that refers to ICE chasers, to follow the vehicle.

Each day, the activists create a new group chat for each zone, with previous chats being routinely deleted to avoid detection. The chats hit the maximum capacity of 1,000 by midday each day.

Higby further explained that the “quasi police force” use a system called “SALUTE” which stands for “size of federal units, activity, locations, uniforms, times and locations.” They instruct ICE chasers to follow and confront agents using this system to known locations.

“THEY ARE EVERYWHERE AND LOCAL POLICE ARE COOPERATING,” Higby added. He showed evidence of one “observer” calling out a possible agent but because she is out walking her dog and can’t continue, the “dispatch” called for “backup.” Another message indicated that local police will “get involved” if ICE “hinders public safety.”

Higby also revealed that the activists have a “home base” for their operations, but he as not been able to identify where it is located. He also described a broader support network connected to the operation, including a mutual aid group for educators.

“The protestors use a ‘mutual aid’ system. I tried to join the mutual aid that for Bloomington. An admin told me that it was a vetted chat for teachers and that I’d need to describe my relationship to a school. And give my real name. I couldn’t do that so I never made it in. Why are there teachers aiding in this effort?!?!”

According to Higby, the operations run around the clock.

“ICE chaser operations go all night. The dispatch call is 24/7. These are messages screenshotted at 2am asking for observers at a location with potential illegals.”

Saturday, January 24, 2026

Friday, January 23, 2026

Thursday, January 22, 2026

Tuesday, January 20, 2026

Monday, January 19, 2026

Gold And Silver Explosion: Something Big Is Happening

Gold and silver prices, according to Brandon Smith of Alt-Market.com, are signaling stress under the surface of the economy. From shrinking physical inventories to record central bank buying, precious metals warn that the underlying issues aren’t resolved…

In early 2020 at the beginning of the pandemic hysteria I noted that the covid panic seemed to perfectly coincide with the Federal Reserve’s acceleration of interest rates and asset dumping. This trend, I argued, was a precursor to a Catch-22 scenario I have been warning about for some time.

Since the crash of 2008, the central bank has used stimulus measures and near-zero interest rates to protect “too big to fail” corporations while keeping debt afloat globally. Doing this required the digital printing of tens of trillions of fiat dollars and, inevitably, a sharp devaluation in the greenback.

I predicted that this would lead to stagflationary conditions (which finally hit in 2022), and the conundrum of inflation vs. deflation.

The Federal Reserve could continue to keep rates low and ignore inflationary pressures to avoid a collapse of debt.

Or, they could significantly raise interest rates, let the debt system take its medicine and tumble in price and squelch the effects of inflation by suppressing consumer demand.

Either choice could cause an economic crisis.

Maybe it’s understandable that the Fed decided not to choose.

Instead, they raised rates but not enough to reverse stagflation. They took the middle road and refused to allow the economy to take its much-needed medicine, postponing a reckoning for badly-priced malinvestments.

Essentially, kicking the can down the road for the next administration to deal with.

Consequences of the Fed’s too-little-too-late strategy

This means we are still stuck with the massive price increases we incurred during the Biden Administration.

Granted, the rate of inflation has slowed. But the cost of living is significantly higher than just five years ago. (Remember, above-zero inflation doesn’t mean prices fall – it means they keep rising, but more slowly.)

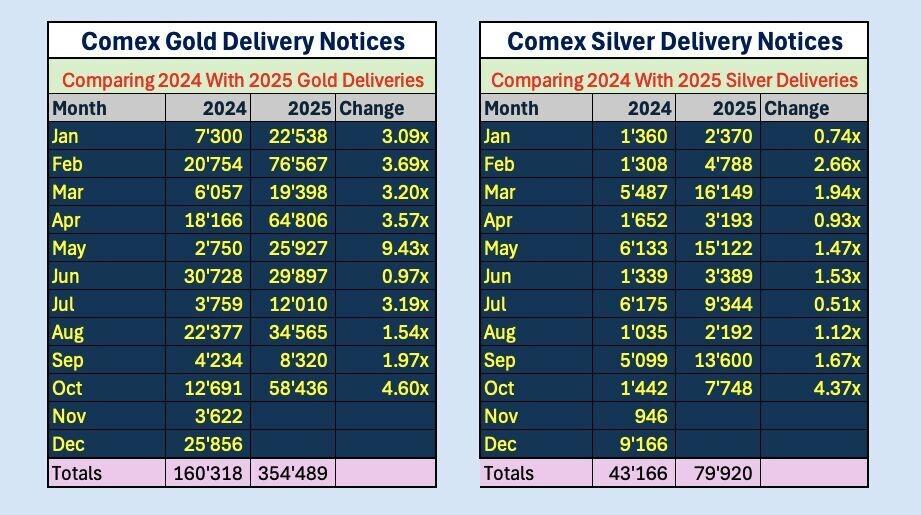

In 2020 I wrote an article titled Physical Gold Will Soon Break Free from the Paper Market in Spectacular Fashion, predicting skyrocketing precious metals values once this Catch-22 situation became apparent to investors. I predicted that buyers would increasingly drop financial derivatives (futures etc.) in favor of physical delivery of gold and silver, causing physical prices to go parabolic.

This is now happening.

Since I wrote that article, the price of gold per ounce jumped over 200%. Silver prices have exploded by 400%.

Global inventories of physical metals have plunged

London vaults are reportedly down 30% since 2022

Refiners report 10-14 week delays for new bullion bars (vs. normal 2-4 weeks)

Physical redemptions of commodities contracts have accelerated to historically unprecedented levels

Via Clive Thompson on LinkedIn. Thompson adds: “This marks a dramatic behavioral shift: historically less than 1% of COMEX contracts resulted in physical delivery, but in 2025, some months delivery notices reached 100%.”

Silver is sitting at an all time high of $90 an ounce as I write this. Gold is closing in on $4700 per ounce.

(Maybe large banks like JP Morgan are deliberately backing away from market manipulation for some reason?) Global central bank gold buying has reached historic levels every year since 2022, surpassing even the levels we saw in the wake of the Great Financial Crisis.

All that is background – what does it mean?

The economic singularity

It seems to me that we are witnessing an economic singularity – a moment of great change.

Or, at the very least, the warning signs of an imminent change.

Precious metals prices are trying to tell us something.

The problem is, that message is mostly being ignored, even by more conservative platforms. Not enough people are talking about what’s happening with precious metals and what it means for the economy as a whole.

Here’s what I think…

First, the rush to physical assets suggests that banking institutions, governments and the wealthiest 1% of investors are scrambling to hedge in preparation for a true crisis. (I’m specifying institutions and the very wealthy because a single COMEX gold delivery contract represents 100 oz. of gold, nearly half a million dollars at today’s prices – well outside the typical American family’s means.)

As I noted in 2020, when the banks start rushing to buy physical gold and silver, then the rest of us should do the same. They are likely acting to counteract losses in other assets. Or they are forecasting some kind of geopolitical earthquake that will send prices exploding.

It’s not hard to see the potential for geopolitical conflict right now. European governments have become increasingly hostile to the U.S. over tariffs. They keep trying to start World War III with Russia and so on.

Second, there are the domestic problems caused by protests against immigration enforcement. The deportation issue is merely a convenient excuse for wider conflict between the left and the right. )If ICE agents went home tomorrow and stopped their arrests, the left would find something else to riot about.)

Just as we witnessed in 2020, domestic chaos is a tool for political extortion. In the meantime, civil instability helps fuel the rise in metals.

Third, there are the tensions with Russia and China, who are not happy with the capture of communist dictator Nicolás Maduro. Venezuela’s oil exports have been vital to China’s industrial capacity. Though Venezuela’s supplies only made up around 4.5% of China’s imports, a loss of 4% or more in a volatile global market is unwelcome to say the least.

Venezuela has served as a launching point for military assets in the western hemisphere (including surveillance systems to watch the U.S.). Chinese and Russian weapons failed miserably against U.S. operations, which might lead to escalation going forward.

The larger effects of Maduro’s removal can’t be quantified yet, but they will be consequential.

Most Venezuelans seem overjoyed by their liberation from Maduro. The question is, can we avoid a long-term quagmire? Our military excels at blowing up enemies with precision, but we have a miserable track record at long-term military occupation.

Fourth, let’s not forget the protests in Iran and the potential for regime change there. I have no personal stake in terms of what happens in the Middle East. I think the U.S. should stay out of the mess as much as possible, but I have no illusions that Trump is going to quietly sit back and just watch. He’s proven to be a man of action.

I have to admit, his decisions on foreign policy have been surprisingly effective and welcomed by the populations involved – in most cases at least. That said, when geopolitical conditions shift so quickly, this inevitably sends shockwaves through the global economy. Even when the action is morally correct and strategically necessary, the consequences are unpredictable.

Finally, the Fed appears intent on cutting interest rates without ever addressing the original stagflationary problem. Consumer spending never went down. Debt accumulation, at the federal and the household level, continues to grow. Prices are still high on most goods compared to 2020. The U.S. has to suffer through at least a short-term deflationary period in order to correct for stagflation, and the banks have done everything in their power to avoid this.

In other words, if the Fed continues to cut rates then inflation will a comeback in 2026.

Here’s what happens next

I believe all the right factors are in play for a continued gold and silver run.

I would not be surprised to see silver close to the $200 per ounce mark by 2027. The combination of demand for all the various industrial uses of silver combined with the multi-year supply deficit, on top of the U.S. decision to declare silver a critical mineral – adding in China’s attempts to ban silver exporting PLUS the insatiable demand for silver as an investment? This is a combination of forces all but guaranteed to send price higher. And they aren’t any more “transitory” than the Covid-era inflation spike. I predict these forces will drive the gold/silver ratio to levels last seen during the spike of 2011 (35:1), which would put the price closer to $131 per ounce today.

I’m not seeing any indication that global pressures are going to slow down anytime soon. In fact, I think precious metals are telling us that things are about to get much more chaotic.

Today, maybe more than ever, owning physical gold and silver is a declaration of financial liberty. Of independence from the fiscal chaos of the Federal Reserve and federal government debt.

Sunday, January 18, 2026

Saturday, January 17, 2026

Friday, January 16, 2026

Thursday, January 15, 2026

Wednesday, January 14, 2026

The Forgotten Man

Authored by Be Water,

The 2008 Crisis Never Ended

Do you wish to know [when] that day is coming? Watch money. Money is the barometer of a society’s virtue. When you see that [commerce is conducted], not by consent, but by compulsion—when you see that in order to produce, you need to obtain permission from men who produce nothing—when you see that money is flowing to those who deal, not in goods, but in favors—when you see that men get richer by graft and by pull than by work, and your laws don’t protect you against them, but protect them against you–when you see corruption being rewarded and honesty becoming a self-sacrifice—[then] you may know [that day has arrived]…

—Francisco d’Anconia

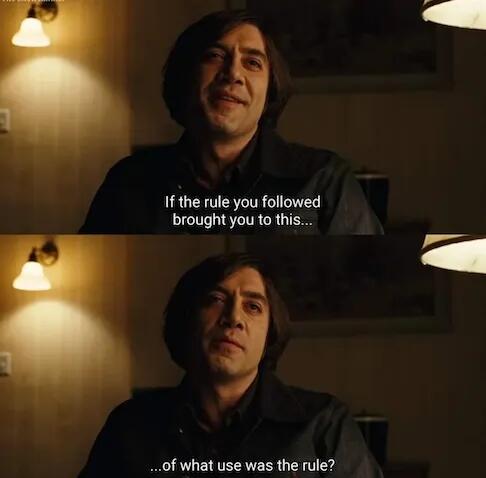

No Country For Young Men

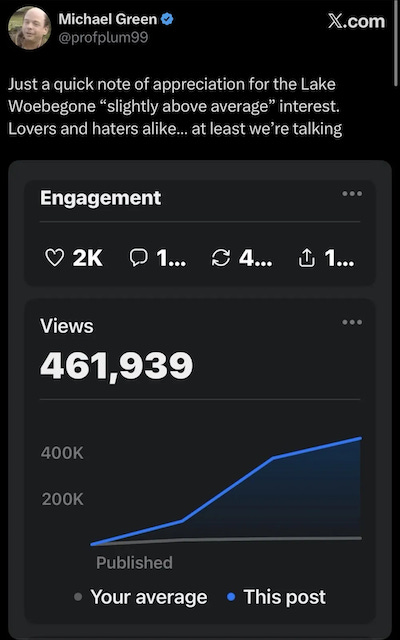

For most of America, the headlines trumpeting a “strong economy” and “stocks at record highs” land like a cruel joke. Michael W. Green’s recent series My Life Is A Lie attempted to quantify the economic devastation felt by the majority of the country these many years. This carnage has been sanctified by our technocrats—an Aztec priesthood invoking sacred economic statistics as celestial omens to justify the ritual sacrifice of society on the altars of GDP and the S&P 500.

Green, an investment industry insider, gave voice to the Forgotten Man:

Predictably, the priesthood declared heresy. Economists, journalists, thought leaders, think tanks, and other fellow travelers circled the wagons, tearing apart Green’s numbers, splitting hairs, and nitpicking his methodology.

That is a grave mistake.

Fiddling While Rome Burns

How can you expect a man who’s warm to understand a man who’s cold?

—One Day in the Life of Ivan Denisovich, Alexander Solzhenitsyn

This sort of wonkish debate—whether the poverty line is $30k or $140k, whether CPI is 2% or 4%—exemplifies the scientism enabling our national dissolution: the religious belief that the statistical map is more real than the economic territory. Perhaps such effete technocratic sophistry could be tolerated—even indulged—were the body politic unified. But it is a fatal conceit in such a Balkanized powder keg of a nation.

Into this highly combustible environment, Green’s essays landed like an errant spark. If nothing else, Green forced a long-overdue reckoning with a reality that the credentialed class has steadfastly refused to acknowledge: that they themselves have spent decades drowning the American Dream in a flood of ruinous policy, even as they now insist that the water level is perfectly fine and that Americans are simply bad swimmers.

Such an acknowledgment, however, would be tantamount to confessing that their entire worldview—the long Postwar Consensus—rests on a meticulously constructed lie. That the intellectual facade of modern finance and economics, the modern monetary system and central banking, fiscal and monetary policy, financialization, globalism—all of it—has strip-mined the nation and fracked the American bedrock, leaving behind a slag heap of poverty, misery, and rage in place of the prosperity it promised.

That their own lives have been a lie.

From Picket Fences To Shoebox Micro-Apartments

The party told you to reject the evidence of your eyes and ears. It was their final, most essential command.

—Winston Smith

Whether Green’s numbers withstand academic scrutiny is altogether beside the point. His essays struck such a visceral nerve because Green—as someone with institutional investment credentials—put numbers to what millions have experienced firsthand for decades. And he did so at precisely the moment when their long-simmering rage is boiling over.

And then the Minnesota headlines broke.

If Green’s essays were a stray spark drifting toward the powder keg, these revelations of fraud represented a blazing torch hurled straight at it. Billions have been bled from the American middle class—those who can barely afford their own children—to bankroll the imaginary children of fraudsters.

But the scale of the plunder extends far beyond one state:

The populace’s rage, therefore, springs from a well far deeper than Green’s economic statistics—or any one else’s, for that matter—could ever fully plumb. Understanding this fury—and its implications for both our civilization and our portfolios—requires returning to an existential question we posed five years ago: how did we devolve from the society depicted in the New Yorker’s 1957 Christmas cover (left) to that depicted in its 2020 Christmas cover (right)?

Source: The New Yorker

These two contrasting images—set six decades apart—bear witness to a birthright betrayal so absolute that it defies measurement. The transformation seems inconceivable: in the course of a single lifetime, how did the most prosperous civilization in history come to cannibalize its children’s futures?

Asked differently, how could prior generations buy houses, raise families, and afford healthcare on a single income—and then retire—while younger generations drown in debt, face bleak job prospects, are cursed to rent forever, risk financial ruin from hospital visits, and accumulate pets rather than rear children?

Why do so many feel worse off than even a decade ago, despite record asset prices and strong GDP growth? And why has this malignancy metastasized simultaneously throughout the Western world—the US, Europe, Canada, Australia?

The answers won’t be found in economic textbooks, models, and policy papers that led us here in the first place. Nor will they emerge from the clerisy who authored them:

But answer these questions, and the chaos of our age suddenly resolves into clarity: not only the financial stress, but the seething rage erupting across Western nations worldwide. The collapse not merely of institutional trust, but of societal trust writ large. The rise of populism and politically motivated violence. The pervasive sense that the very fabric of civilization—if not reality itself—is being torn apart at the seams. The gnawing feeling shared by ordinary people that they are struggling to survive a precarious interlude before some major cataclysm strikes.

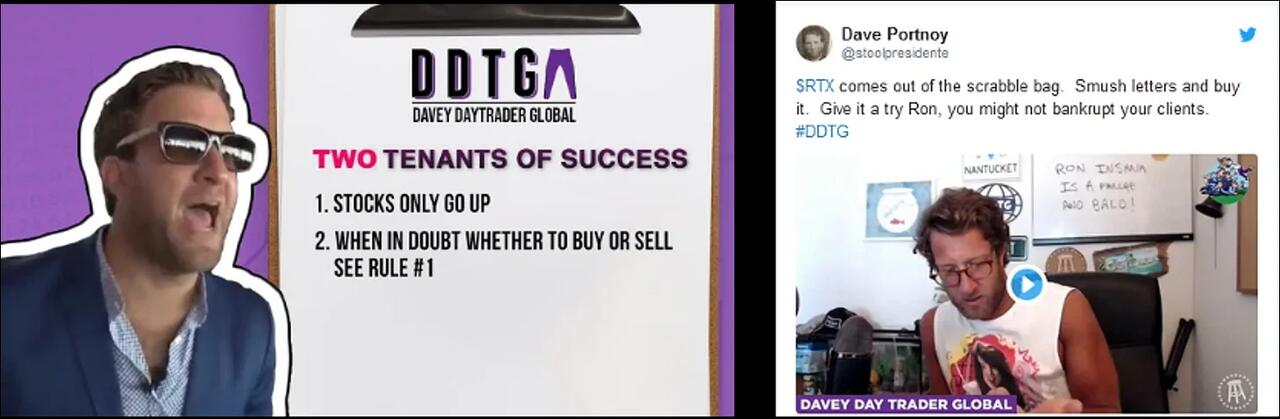

Mr. Market’s Schizophrenic Break Of 2020

The madness of the 2020-2021 COVID era was apocalyptic—literally a lifting of the veil: governments induced a global economic coma yet asset prices—the economy’s vital signs—registered euphoric highs. It was as if a comatose patient’s monitors indicated an Olympic athlete in peak condition—the clearest illustration of what Green is now attempting to quantify.

Meme stocks, fake currencies, and bankrupt companies—indeed all assets—went parabolic even as the economy flatlined.

We call this period Mr. Market’s Schizophrenic Break, the absurdity of which was perhaps best encapsulated by David Portnoy (aka “Davey Day Trader”) picking stocks out of a scrabble bag on Twitter and CNBC—a strategy that consistently worked!

Source: @stoolpresidente

Source: @EnronChairman

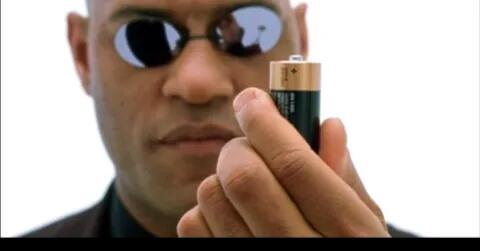

The Financial Matrix

Portnoy himself saw through this surreal facade during the height of the COVID market mania:

The good news is I know it’s rigged. The government is [saying] don’t worry we’re just gonna create a trillion-billion-zillion dollars. It’s fantasy land. It’s Schrute Bucks [fake money from a popular TV show]. It’s the worst coronavirus day in a while and the government is saying don’t worry about it cause we’re gonna print a quadrillion dollars and the market sky rockets. The stock market is disconnected from reality. The whole thing is a pyramid scheme. We’re living in the Matrix.

Portnoy wasn’t merely ranting, however—he had unwittingly laid bare the central economic mystery of our age, one that somehow eluded our credentialed classes: that the numbers and charts streaming across Bloomberg terminals had become utterly divorced from the reality of everyday life.

In this inverted Bizarro World, bankruptcy was bullish, currencies invented as a joke were enormously valuable, and picking stocks from a Scrabble bag was a wise investment strategy.

With a degenerate gambler’s uncanny intuition for detecting rigged games, Portnoy had stumbled onto a profound truth: that financial reality had somehow been replaced with an elaborate, videogame-like simulation—the Financial Matrix. This self-contained universe was governed by its own laws and utterly indifferent to the world it was supposed to represent.

The 2020-2021 COVID madness represented the reductio ad absurdum toward which the entire post-War policy consensus had been hurtling—the culmination of decades of pathology that had metastasized to such absurd extremes that it became impossible to ignore even for laymen like Portnoy and his “degen” followers.

But while Portnoy had correctly identified the symptoms, he had not diagnosed the underlying disease. Five years ago this month—amidst the heights of the COVID market mania—we set out to identify the cancer at the heart of the global financial system, to understand how virtual reality had replaced reality, and to assess the implications for investing.

The result was The Sorcerer’s Apprentice & The Man Who Broke The Markets. In Sorcerer, we traced the vectors of metastasis—monetary, memetic, algorithmic—that had spread through the global financial system, mapping the ways this cancer would ultimately upend markets, economies, and societies worldwide.

We originally published Sorcerer privately in January 2021. However, as the pathologies we diagnosed then have only intensified in the interim, we felt compelled to expand and update the work for a public audience. This growing urgency also explains why Green’s recent series resonates so deeply now. The economic cancer we diagnosed in late 2020—having metastasized invisibly for decades, revealing itself only in occasional paroxysms, as in 2008—finally became impossible to ignore when the COVID policy response devoured economic reality itself in 2020-2021, and then in 2022 ignited the worst inflation in five decades.

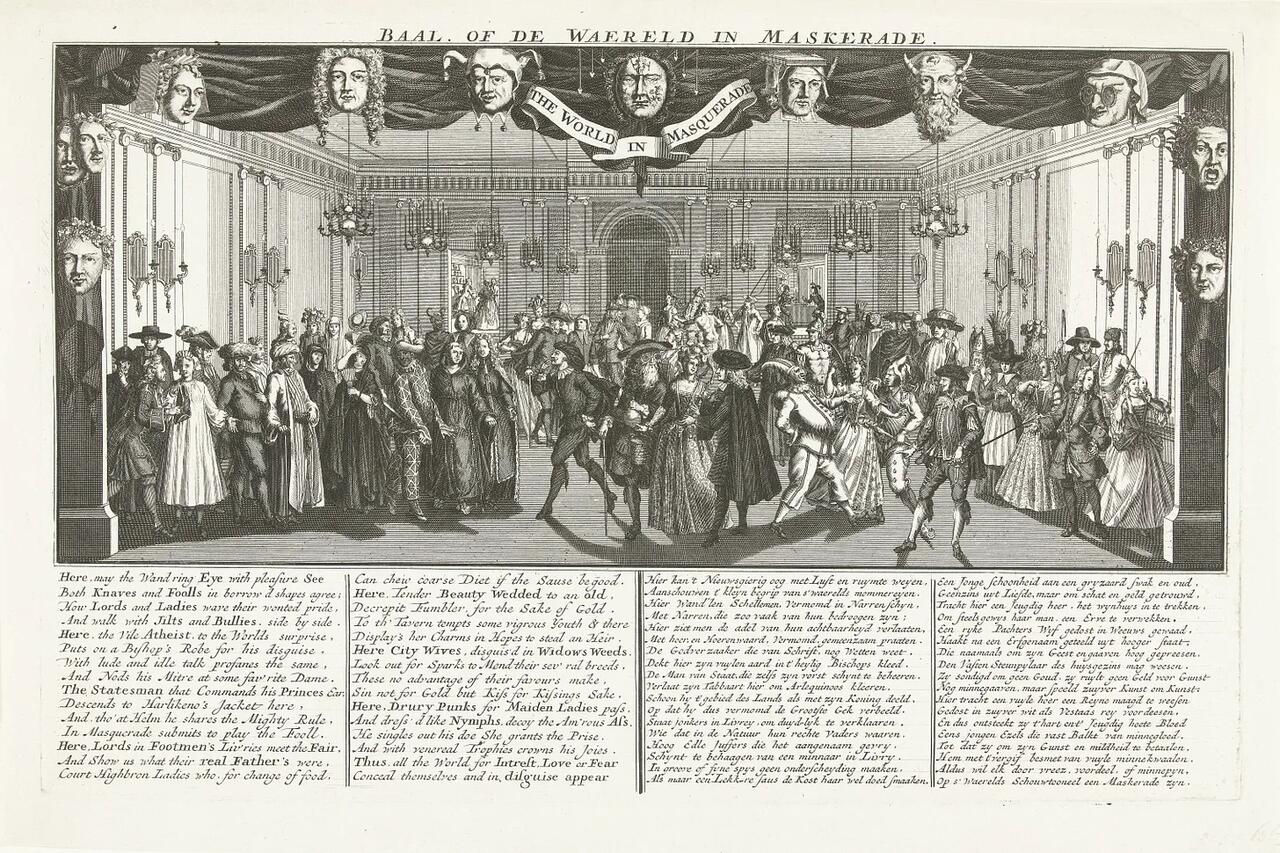

The Day Is Come

The COVID years—and beyond—mark the fulfillment of Francisco d’Anconia’s prophecy. He exhorted us to watch the money—to read it as the barometer of a society’s virtue. He warned of the day when ‘money is flowing to those who deal, not in goods, but in favors’ and when ‘men get richer by graft and by pull than by work.’

Look around. That day is not coming; rather it is already here. Green’s essays and recent news headlines merely crystallized the gnawing suspicion that has haunted the American subconscious since at least the 2008 Crisis: that for decades the productive American citizen has been taxed and inflated into serfdom—forced to finance their own dispossession and the demolition of their way of life. Americans have been reduced to human batteries whose life force powers the Financial Matrix.

It is even now dawning on the citizenry that the “strong economy” and “record-setting stock market” are merely mirages conjured by the Financial Matrix—phantom metrics generated by and for the simulation. Meanwhile, in the ‘desert of the real,’ the productive have been treated as enemies, and “those who deal in favors” preside over a Witches’ Sabbath wherein swindlers parade as sages and vice dons the robes of virtue:

Baal, or the World In Masquerade

Here, corruption is rewarded and honesty has become a self-sacrifice—the laws no longer protect you against them, but protect them against you: “for my friends, everything; for my enemies, the law.”

----------

Up Next: The End Of Illusion

In Part II: The End Of Illusion, we will examine the pincer now closing in on American—if not global—capital: the overt collectivism rising in major cities like New York and the command-economy dictates descending from Washington. As it becomes increasingly unwieldy to maintain the Financial Matrix’s illusions, those operating it—as well as those opportunists exploiting the mounting chaos created by the system—are abandoning the pretense of market mechanisms for more naked political control.

Whether the Financial Matrix can sustain ‘record highs’ in the stock market—at least in nominal terms—should now be of secondary concern.

The era of investing primarily for ‘Return on Capital’ has ended. The primary objective must now be ‘Return of Capital’—quite literally.

The investment ‘truths’ of the pre-COVID ‘Goldilocks years’ were a digital mirage, sustained only by the artificial logic of the Financial Matrix. Now, however, the code is glitching. As the simulation crashes headfirst into the volatile reality of Multiflation, rigid adherence to these old certainties is becoming a dangerous liability.

The pincer crushes what is fixed, yet cannot grasp what is fluid.

Be Water.